Excellent resources, proven experience and financial incentives make APAC a smart choice for First-in-Human and early phase clinical trials.

Clinical trials are moving east

Challenges to conducting trials in the West, especially recruitment difficulties, have made the APAC region a preferred destination for clinical trials. APAC offers a high availability of patients, worldwide accepted data quality, an increasingly high quality infrastructure and access to KOLs across therapeutic areas with global experience. According to Clinical Trials Database of GlobalData’s Pharma Intelligence Center, the APAC region was the most active region for both industry and non-industry sponsored clinical trials activity in Q1 2021.

With lower operational costs, significant savings can be realized in the APAC region in comparison to developed markets. Advanced healthcare systems and many U.S. and European trained doctors in Australia, Singapore, Taiwan, Korea and Hong Kong, as well as a digital explosion due to the pandemic all make the region more attractive. According to a Grand View Research Market Analysis Report, the APAC market for clinical trials is anticipated to witness the fastest CAGR of 6.7% from 2021-2028 to reach U.S. $6.3 billion by 2027.

APAC has the experience to conduct early phase global trials

While it is widely known that APAC is a reliable destination for Phase II and Phase III studies, researchers are finding that success can also be achieved with early phase and First-in-Human (FIH) trials. Early phase clinical trials form the very foundation of a drug’s clinical development and have traditionally been performed in Western populations. Recognition of differences in disease epidemiology in different populations/geographical areas, and potential pharmacogenomic differences between ethnicities make the APAC region attractive — and important — as a trial location. Research conducted from the earliest phase of drug development on populations which will eventually have a high proportion of use has fortunately become more relevant to the industry.

According to clinicaltrials.gov, of the 6,900 Early Phase and Phase I clinical trials conducted between January 2019 and January 2021, 1,470 were in East Asia, 47 in South Asia, 105 in Southeast Asia, 175 in Japan, 299 in Australia and 40 in New Zealand. That’s roughly 31% of all Phase I clinical trials being conducted in the APAC region during the last two years.

Financial incentives in Australia

There are often financial incentives for “going to APAC.” Consider Australia, where trial costs are competitive and, in early phase clinical trials, Australia is 28% less than the U.S. before Federal Government tax incentives, and 60% less after tax incentives. (“Why conduct a clinical trial in Australia; Australian Clinical Trials“) The government offers an R&D tax incentive providing eligible companies with up to 43.5% of the money spent on certain research activities, which Phase I studies will almost always fulfill. The Incentive provides businesses investing in eligible R&D with generous tax offsets.

Depending on your company’s annual turnover, the R&DTI provides either a refundable or non-refundable tax offset.

- 43.5% refundable tax offset is available to companies with an annual turnover of less than $20 million.

- 38.5% non-refundable tax offset is available to companies with an annual turnover is more than $20 million.

Read more about the Australian R&D Tax Incentive here.

Apart from cost, Australia offers other benefits, including streamlined regulatory and ethics approvals. Though a strict, globally competitive ethics committee approval is still a main requirement, sponsors do not need to submit an Investigational New Drug (IND) (or similar) before beginning an FIH clinical trial in Australia. Through Australia’s regulatory body Therapeutic Goods Administration (TGA) and The Clinical Trial Notification (CTN) scheme, response can come quickly, often within a week, expediting startup.

Of the more than $1 billion annually that Australia invests into R&D, at least $50 million goes to Phase I studies, and approximately 30% of all studies conducted in Australia are Phase I. There are five major globally recognized specialized Phase I units across Australia who all have experienced Phase I researchers, and there are around 200 beds that are dedicated for Phase I trials. Along with the efficient regulatory system, this strong infrastructure has seen a 17.2% growth in Phase I trial volume from 2012-2015 compared with 1.8% growth globally. (“The Australian Tour: Phase I Clinical Trial Units; Australian Clinical Trials, 2017; MTPConnect. Clinical trials in Australia: the economic profile and competitive advantage of the sector. MTPConnect June 2017.“)

Australia can also serve as a gateway to conducting regional studies in the broader APAC region where there is a large and diverse patient pool of four billion citizens — two billion close to urban areas.

Emerging markets in the APAC region

As the region continues to grow in capacity for clinical trials there are many countries that are quickly becoming choice locations, notably South Korea, Taiwan and Hong Kong as well as Singapore, Malaysia, Thailand, the Philippines, Indonesia and Vietnam. Demographically these countries represent excellent recruitment patient pools — rich mix of ethnicities, growing health consciousness, and the right mix of ages and incomes. These countries are competitive in their benefits including the ability to handle large trials, infrastructure, site experience, specialized trial centers and tech expertise. Recent data shows Hong Kong is a good location for Phase I Pharmacokinetics study to support registration in China.

Focus on early phase

South Korea has risen to a top 10 location globally in number of studies conducted each year. In 2013 there were 39 newly initiated Phase I clinical trials, while in 2019-2021 there were 275. Over 170 sites are qualified for clinical trial conduct, and major institutions, such as the Seoul National University Hospital Clinical Trial Center, with Phase I units and Cancer Centers make South Korea a good location for early phase oncology trials with proven quality and promising recruitment. (“Challenges and insights of early oncology drug development in the Asia-Pacific region: introduction of Phase I oncology clinical trial center and experience sharing for early clinical trials in Seoul National University Hospital, Korea, 2019“)

Taiwan has carried out FIH trials in chemical drugs, biologics, vaccine and cell therapy. With one of the most progressive healthcare systems in the world and a world-class infrastructure, it has become a major hub for clinical research. The dense population enhances and expedites patient recruitment. Taiwan is also a good location for bridging Pharmacokinetics studies to fulfill local regulation requirement. The research community is fully supported by the Taiwanese government, and with a 2010 agreement between the Taiwan Food and Drug Administration (TFDA) and its Chinese counterpart, Taiwan is capable of extending trial diversity. From 2019-2021 Taiwan conducted 97 early phase trials. (“Why Taiwan? Published by Ministry of Health and Welfare, TFDA and Taiwan Center for Drug Evaluation, 2020“)

Fastest growing oncology sector sees development of Phase I Consortiums

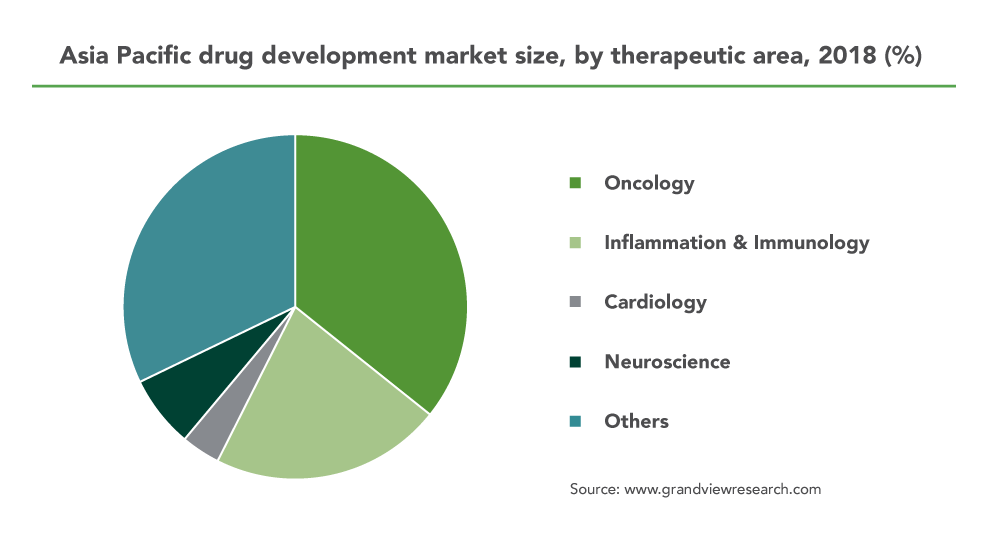

In all trial phases, the oncology segment has dominated the market and accounted for the largest revenue share (23.4%) in 2020. It is also predicted to see the fastest CAGR of 6.2% through 2028. According to the FDA, the pharmaceutical industry spends more than U.S. $38 billion towards preclinical and clinical development of oncology therapy products. And the APAC region is prepared to address the needs of the early phase oncology trials.

In late 2017, Asian Early Phase I Oncology Drug Development Consortium (AsiaOne) formed across early phase new drug development institutions (key oncology Phase I centers) in Hong Kong, Japan, Republic of Korea, Singapore and Taiwan. AsiaOne will drive the momentum towards international collaborative Phase I clinical trials across Asia. By 2019, the total number of oncology Phase I trials involving AsiaOne sites were increasing, and more than half of FIH trials were global trials. One of George Clinical’s Scientific Leaders, Dr. Herbert Loong, is on the Executive Committee of AsiaOne.

The Chinese Phase I Oncology Trial Consortium was founded in June 2017 and focuses on facilitating cooperation between study sites, sponsors and CROs. The Consortium provides a platform for sharing experience and expertise. For studies targeting less rare cancer mutations, the Consortium assists in patient recruitment by referring patients with specific mutations to corresponding clinical sites. The number of investigational new drug filings has almost tripled since the Consortium was formed, and focus has shifted from generic drugs to innovative drug R&D and the promotion of novel study designs.

China made significant regulatory reform in 2017 making the clinical trial process in China increasingly more appealing, efficient and effective. In 2018, a comprehensive survey of China’s anticancer drug R&D landscape showed:

- 102% increase in the number of oncology Phase I trials

- 85% increase in the number of oncology Phase I agents in mainland China

- A total of 312 agents being tested in 364 Phase I studies in 2018, spanning 83 Phase I study sites in 22 different provinces

- Increase in the number of FIH studies from 9% (16/180) to 15% (53/364) in one year

- Phase I cell therapies increasing from 5 to 11 in a single year

Cancer cell therapy and biospecific antibody are the fastest-growing sectors. (“Zhao, S., Zhao, H., Lv, C. et al. Anticancer drug R&D landscape in China. J Hematol Oncol 13, 51 2020“)

George Clinical: Strong in APAC and Scientific Leadership

George Clinical has been conducting trials in this region for more than 20 years and offers first-hand experience in regulatory matters across the region. In addition, we have distinguished Scientific Leaders in a number of therapeutic areas, including kidney & metabolic and oncology, who are able to help with trial design and input into operational strategy. We can move through the regulation process to quick startup and help you think through your early phase trial strategies, site selections and operational models. With the combination of our scientific expertise and local knowledge, George Clinical trials maintain their focus on the scientific objective while maximizing site selection, recruitment and overall trial efficiencies for the best result possible in any phase of research.